It’s a new year and we’re all excited for more growth in 2024.

And one of the most popular questions that we’re being asked on the phone every day is:

“How much should I spend on my marketing in 2024?”

And the answer may surprise you…

Because there are really two ways you can decide how much you should spend on marketing.

Takeaways

- To calculate how much should you spend on marketing, multiply your Customer Acquisition Cost by the number of customers you want.

- Knowing your customer’s LTV is important because it will ultimately determine how you can scale your marketing budget.

- The more often you can get people to come back to your product, the stronger your LTV will be.

How Much Should You Spend On Your Marketing Budget

The first way is the super easy and lazy way which is to do something like take 10% of the revenue you made last year and make that your marketing budget.

So if you made $100,000 then your marketing budget for 2024 should be $10,000.

But this way of calculating your marketing budget isn’t just lazy, but it also limits your potential.

Think about it, what if you are able to invest $20,000, $30,000, or even $50,000 in your marketing and that leads to a 10x growth?

While this may be risky, we’re going to show you how to play it safe by taking a methodical approach to scaling your small business marketing budget.

Formula To Calculate How Much Should You Spend On Marketing

So let’s dive in by just giving the formula that we like to use for marketing budgets.

Now CAC stands for Customer Acquisition Cost and a lot of this post is going to focus on how to determine your max customer acquisition cost.

We’re going to help you accomplish this by asking you some questions and giving you some things to think about.

Through this, you can figure out how much you should spend on your marketing in 2024. Let’s get started!

4 Questions To Help You Calculate Your Marketing Budget

Question #1: How much time are you willing to commit?

This is an important question to ask yourself because if your time is limited then you’re going to need to hire someone to do this for you.

And hiring someone might be your first expense. Now, this is NOT factored into the marketing formula we just looked at, but just something to be aware of.

So when it comes to hiring, generally, you have 3 options.

- You can hire an employee part-time or full-time, which for someone with 1-3 years of experience, you’re looking at $20-30 per hour.

- You can hire a digital marketing agency like us, and our rates start at around $600/month.

- You can hire a freelancer or contractor, whose prices can vary, but in general, you’re going to need to spend about $50/hour for someone good.

There are pros and cons for each option as well.

For example, if you hire a freelancer, they could end up not showing up or prioritizing your work,

Whereas if you hire an employee, you could spend too much time on training or administration.

Now of course, if you plan on doing your digital marketing strategy then you’ll be protecting cash flow, which is okay,

But just make sure you are using your time wisely because there could be a significant opportunity cost of you doing this.

Alright now, let’s move into some questions for determining your max CAC or customer acquisition cost.

Question #2: What is the LTV of your customer?

LTV stands for Life Time Value which is simply the total amount of revenue (or value) you receive from your customers over a lifetime.

This is absolutely critical to know because LTV will ultimately determine how you can scale your marketing budget.

Because the higher the LTV, the higher you can spend and the faster you can grow.

Look at the formula like this.

For instance, if your LTV is $100 and you want a $20 profit then your max CAC is $80.

But then, you have early-stage companies who have enough financial backing that they can sustain a loss to acquire customers.

For example, looking back at Max CAC = LTV – Profitability, if your LTV is $100 and you can handle a $20 loss then your max CAC is $120.

And there’s a famous quote from Dan Kennedy which reads:

“The business that can spend the most to acquire a customer – wins.”

Now that we know how crucial LTV is, let’s look at how to calculate it in our next question.

Question #3: What is your current or forecasted AOV?

Now, the Average Order Value or AOV is simply the average price your customer pays for your service or product.

So, if you have one product that is priced at $100 then your AOV is $100.

BUT, if you have multiple services and products then getting your AOV requires a little bit more work.

The best way to do this is by looking at the historical data.

If you have an established company, gather some historical data that gives your total revenue divided by your total clients.

If you’re a new company, then try forecasting which products/services will have the most demand and calculate an average based on that.

You can always adjust your forecast as you get more data

Question #4: How many times will my customer buy?

In other words, what is the expected usage of your product/service?

Will it be a one-time purchase with no cross-selling like a stationary bike?

Is it a monthly service/product that will recur every month like our internet marketing services?

Is this a product that will have a high usage rate and will need to be reordered like food or toiletry?

Determining this is what helps you get to that LTV we talked about earlier.

And the more often you can get people to come back to your product, the stronger your LTV will be.

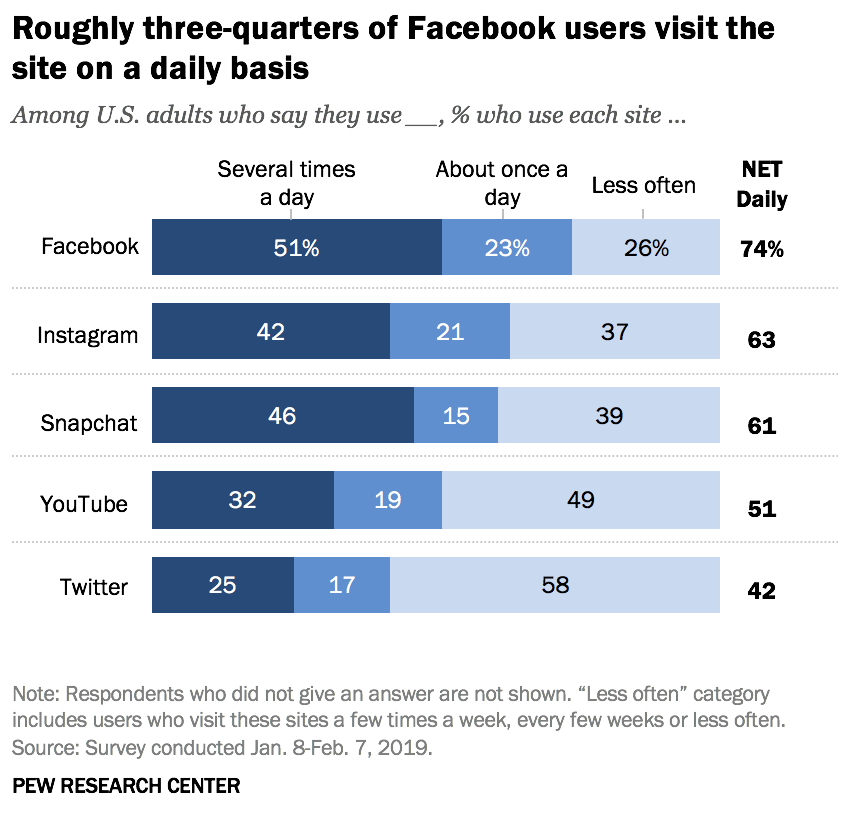

Think about Facebook, for example.

Their goal isn’t to get you to visit their site one time, but to keep coming back every day and then stay for hours.

You’ll take your average order value × purchase frequency to get your LTV.

So here are all the calculations:

AND

AND

This way, you are acquiring customers at a rate that aligns with your risk tolerance.

Example On Calculating A Marketing Budget

Now let’s tie all this together with a fake example of how much should you spend on your marketing with this process.

The numbers we’re going to use are going to be small and flat, just to make things easier to follow.

So let’s say company ABC has an average order value of $50 and their customers tend to buy from them 4 times a year.

Their customer value in year 1 would be $200. And you certainly can base your marketing budget on year 1 if you’re a new business.

But let’s say company ABC has been around for a while and knows their customers normally continue to use their products for 5 years.

This would make company ABC’s LTV approximately $1,000 ($200 x 5 yrs).

Now that we have LTV, let’s calculate their max CAC.

Let’s say company ABC wants to really grow a 10% profit margin, so we would take the $1,000 – $100 = $900 max CAC.

Now the last thing that needs to be decided is how much cash do they have on hand and how many customers they want to acquire.

Let’s say in this example that company ABC wants to acquire 100 new customers.

Then they should expect to spend about $90,000 on their marketing to hit their goal.

Now keep in mind that at any time, company ABC can readjust its forecast and marketing budget.

For example, they could find a digital marketing campaign mid-year that cuts their acquisition cost in half.

This can give them more room for growth.

And this would change the forecast from 100 new customers to 200 new customers.

So that’s how you scale a marketing budget.

Now You Know How Much Should You Spend On Marketing!

And that’s it! We hope this post will help you think about how much you should on marketing this year.

But if you want to make the most of your marketing budget, we have affordable digital marketing solutions perfect for businesses of all sizes.

Contact us today and our amazing team will be happy to help you.

One Response

Hey Sean, nicely done and written.

Very creative way to do a marketing budget. I must admit I have been doing the lazy way. I have a lot to think about after reading this because its time to scale.

Tks,

Trevor